Mizina/iStock by way of Getty Images

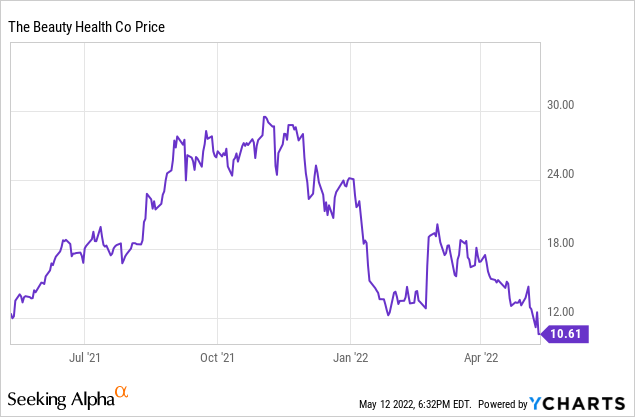

Beauty Health (NASDAQ:Pores and skin) emerged from the pandemic with substance momentum at the rear of it as world need for HydraFacial, its patented non-invasive skincare procedure, ramped up. This intended the company’s operate to a 52-7 days substantial of $30.17 experienced true legs as it was crafted on the back again of audio financials, most notably the era of favourable altered EBITDA.

With the value of its widespread shares dropping by 64.8% from these highs, Splendor Wellbeing has given that come to be element of the excellent collapse of expansion stocks. What does this suggest for a company that proceeds to expand its HydraFacial footprint? With the substantial-conclude facial procedure alternative now out there in about 90 nations and the enhancement of a new shipping and delivery technique, Magnificence Health is signalling to additional prudent prolonged-phrase shareholders that its recent inventory selling price malaise is probable short term.

Potent Initial Quarter Outcomes Press Upward Direction Revision

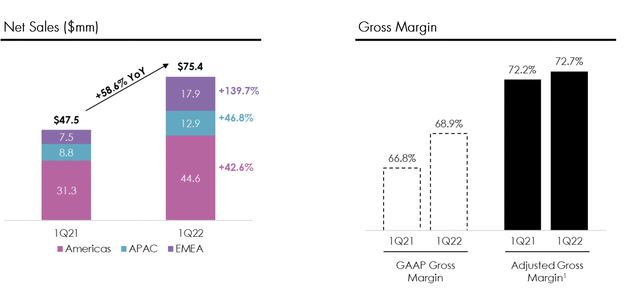

The firm documented earnings for its fiscal 2022 very first quarter just after the current market shut on Tuesday. This saw income arrive in at $75.42 million, a 58.6% improve from the similar yr-ago quarter and a $7.27 million conquer on consensus estimates. Beauty Health and fitness sold 1,849 shipping and delivery devices for the duration of the quarter to improve its put in base to 21,719 with an ordinary providing value of $21,462.

Attractiveness Health

Gross sales in EMEA noticed the biggest percentage enhance at 139.7%. Gross margins also grew on both of those a GAAP and adjusted basis with the latter achieving 72.7%, up 50 basis details from the comparable calendar year-back quarter.

Even so, adjusted EBITDA was down to $2.2 million from $7 million in the calendar year-in the past period of time due to what administration described as ongoing headwinds from world supply chain worries and inflationary pressures. This noticed altered EBITDA margins tumble materially to 2.9% from 14.8%. The corporation, regrettably, expects greater shipping expenditures to continue to weigh down on margins through 2022. Even though this is not welcome news for Natural beauty Health bulls, there was a salve with the firm raising its fiscal 2022 revenue advice. Internet gross sales are now anticipated to be in the range of $330 million to $340 million, up from the previous outlook for $320 million to $330 million. The organization also reaffirmed its steerage for altered EBITDA of not considerably less than $50 million all through the 12 months.

The rapid adverse reaction of the popular shares came on the back of 3 brokerages reducing their value targets on the business. Most notably was Piper Sandler which flagged weakening GDP and shopper sentiment throughout the world as a motive to reduce its numerous on the corporation to 7x approximated fiscal 2023 income compared to 9x earlier. This introduced the value concentrate on down to $24 from $26.

Using the lower finish of Splendor Health’s fiscal 2022 income advice, the corporation presently trades on a 4.85x gross sales a number of with its market cap at $1.60 billion. This gives space for upside if the a number of rises to Piper’s previously lowered several. Further more, Splendor Wellbeing held a materials $859.2 million in cash and equivalents on its harmony sheet, mainly from a $750 million 1.25% convertible notice thanks in 2026. It also retained an undrawn revolving credit history facility of $50 million which the firm states will offer them with overall flexibility for future acquisitions.

Magnificence Wellness

At the main of Attractiveness Health’s marketplace system is its learn program, a string of bold statements to supply on innovation, devote in its manufacturer, and nurture immediate customer interactions. The business also expects acquisitions to perform a sizeable position to make its system shift a lot quicker. The most salient improvement on this was the March launch of Syndeo, a new digitally linked HydraFacial shipping and delivery program. This platform delivers a major technological know-how up grade from the current HydraFacial shipping technique as it brings information assortment capabilities for a individualized and connected practical experience. I expect the new program will aid generate gross sales from Elegance Health’s current customer base as well as new clients moving into the HydraFacial neighborhood.

Skincare Today And Alpha Tomorrow

Magnificence Well being is a target of a great crash whose chapters are nonetheless staying prepared as central financial institutions close to the globe shift to aggressively crush runaway inflation. The crash now supersedes the peak concern we had back again in March 2020 when the entire world really practically shut by itself down and with it the business enterprise types of firms like Magnificence Overall health. The concentration now shifts to the for a longer time-time period likely of a large-excellent firm beset by small-time period headwinds to its business model. The fundamentals issue and Natural beauty Wellbeing has proved by itself to be a prudently run company able to mature profits while even now generating optimistic adjusted EBITDA. The company’s global expansion will aid to sustain its revenue ramp and diversify its profits base. This is specifically true as Europe continues to see rigorous sales expansion. In this regard, this was an outstanding quarter of progress as the enterprise executed masterfully on its grasp system.

More Stories

The Future of Alexandrite Mining: Ethical and Environmental Considerations

The Essential Guide to Piano Moving Services: Key Factors to Consider for a Smooth Transition

How To Get The Most Returns When Selling Gold Bullion